In a recent development that has attracted national attention, the U.S. government and regulatory authorities have announced a formal update regarding the Cash App Settlement for 2025. This update comes as part of an ongoing effort to ensure transparency, accountability, and the protection of digital financial users in the United States. Following investigations into data security lapses, alleged mismanagement of funds, and consumer complaints, the Cash App Settlement aims to provide eligible users with compensation, enhanced security assurances, and compliance reforms from the platform’s parent company, Block Inc.

This formal notice outlines the key aspects of the settlement, including eligibility criteria, the claims process, and the expected timeline for reimbursements. All Cash App users are encouraged to stay informed through official channels to ensure timely action and avoid misinformation.

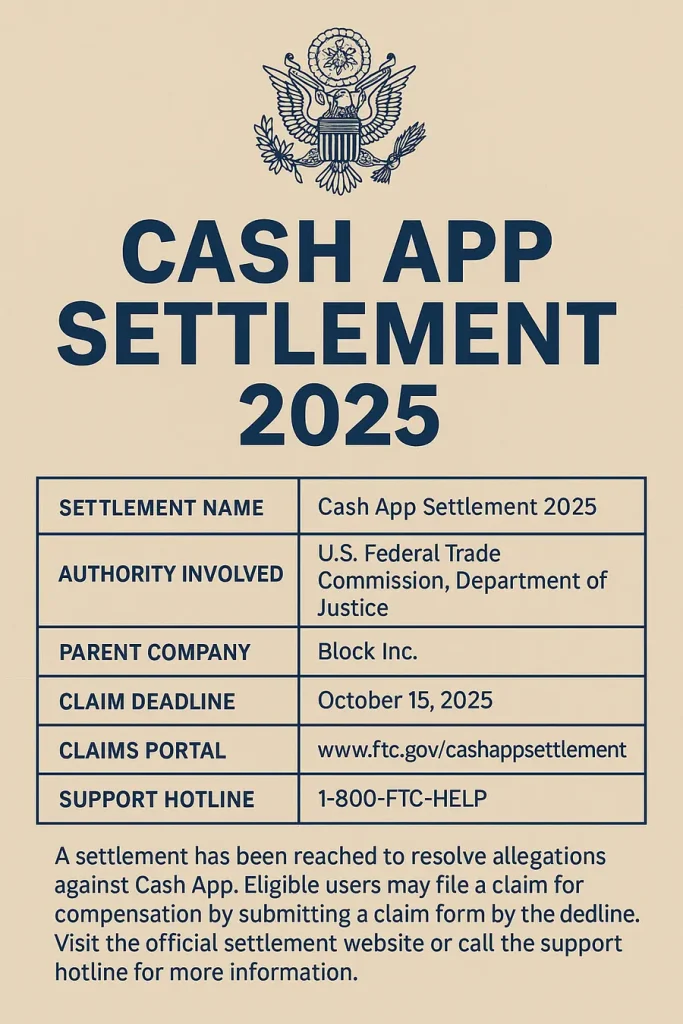

Cash App Settlement 2025: Key Information Overview

| Category | Details |

|---|---|

| Scheme Name | Cash App Settlement |

| Authority Involved | U.S. Federal Trade Commission (FTC), Department of Justice (DOJ) |

| Parent Company | Block Inc. (formerly Square Inc.) |

| Settlement Trigger | Investigation into data breaches, account misuse, and transparency issues |

| Compensation Amount | Varies per user (based on account activity and losses sustained) |

| Eligibility | Users who held or used Cash App between January 1, 2020, and December 31, 2023 |

| Claim Deadline | October 15, 2025 |

| Official Claims Portal | www.ftc.gov/cashappsettlement |

| Customer Support Hotline | 1800-382-4357 |

Background of the Cash App Settlement

The Cash App Settlement was initiated following multiple consumer complaints regarding the unauthorized use of accounts, discrepancies in fund transfers, and weak data protection policies.The Federal Trade Commission (FTC) and the Department of Justice (DOJ) worked together to thoroughly check Block Inc.’s operations. Their findings revealed lapses in user consent mechanisms, notification delays about breaches, and limited remedial measures offered to affected users.

The 2025 update includes provisions for user compensation, tighter regulatory oversight, and mandatory improvements to the app’s data security systems. The Cash App settlement also sets a precedent for future actions related to fintech transparency and consumer rights protection.

Eligibility Criteria for the Cash App Settlement 2025

To qualify for the benefits outlined in the Cash App Settlement, users must meet specific eligibility criteria. These include:

- Having an active Cash App account between January 1, 2020, and December 31, 2023.

- Experiencing unauthorized transactions, account access issues, or unaddressed complaints during the eligibility period.

- Providing documentation or verification during the claims process.

The Federal Trade Commission urges users to review their Cash App transaction history and communication records in order to support their claims adequately.

How to File a Claim Under the Cash App Settlement

Filing a claim under the Cash App Settlement involves a straightforward process through the official FTC claims portal. The steps include:

- Visit the official claims website: www.ftc.gov/cashappsettlement

- Enter your account details: You may need your registered email address or mobile number used with Cash App.

- Upload relevant documents: Include screenshots, transaction records, or complaint references if applicable.

- Submit the claim: Ensure the information is accurate and complete.

- Confirmation: Once submitted, users will receive a tracking ID for future correspondence.

Claims must be submitted no later than October 15, 2025, after which the window will be closed. Fraudulent or duplicate claims will result in disqualification.

Estimated Compensation and Disbursement Timeline

Under the Cash App Settlement, compensation amounts will vary based on the type and extent of the issue experienced. Eligible users can expect:

- Reimbursement for unauthorized transactions

- Credit for delays or transaction errors

- Monetary compensation for emotional distress (in select cases)

The disbursement of funds is expected to begin in December 2025, following the verification of all claims. Payments may be issued through bank deposit, mailed check, or in-app credit.

Government Oversight and Regulatory Reforms

As part of the Cash App Settlement, Block Inc. has agreed to a comprehensive series of reforms monitored by the U.S. Department of Justice and the Federal Trade Commission. These include:

- Mandatory implementation of two-factor authentication for all users

- Quarterly audits of security infrastructure

- Timely breach notifications within 72 hours

- Customer dispute resolution within 14 business days

This action underscores the government’s commitment to regulating financial technology platforms and prioritizing consumer safety in the evolving digital landscape.

Public Response and Implications for the Fintech Industry

The Cash App settlement has sparked a broader conversation about the accountability of digital payment platforms. With over 44 million monthly users, Cash App remains one of the most widely used peer-to-peer payment systems in the U.S. The government’s decisive action signals a shift toward stricter fintech regulation and increased transparency.

Financial experts believe that this case will influence how other digital payment services like Venmo, Zelle, and PayPal operate, particularly in areas involving data security and user rights. Legal analysts also expect a rise in class action lawsuits as users become more aware of their digital rights.

How Users Can Protect Themselves Going Forward

While the Cash App Settlement provides compensation for past grievances, users must take active steps to ensure personal digital security. Recommended practices include:

- Enabling two-factor authentication

- Regularly monitoring transaction history

- Reporting suspicious activity immediately

- Avoiding the storage of large sums in app wallets

Users should also stay updated via the official FTC website and avoid unofficial claims websites or third-party agents.

Conclusion: A Turning Point in Fintech Accountability

The Cash App Settlement 2025 represents a landmark decision in the regulation of peer-to-peer financial applications in the United States. It emphasizes the importance of user data protection, financial transparency, and corporate responsibility. Eligible users are strongly encouraged to take immediate action by reviewing the settlement terms and filing claims before the official deadline.

The federal government’s intervention reflects a growing focus on consumer welfare in the digital economy. As fintech continues to grow, measures like the Cash App Settlement will serve as critical benchmarks for compliance and protection.

Other Helpful Resources

Below are government-related portals and platforms that can assist users with digital schemes, financial aid, and public programs:

- wbindia.in – A centralized portal for West Bengal government schemes and services.

- khadyasathi.in – Official food and ration distribution program under the West Bengal government.

- rationcardindia.com – A national platform providing information on state-wise ration card benefits and updates.

- banglastudentcreditcard.in – West Bengal government’s education loan scheme for students pursuing higher education.

- Purihotelbooking.co.in – Government-authorized hotel booking portal for visitors to Puri, Odisha.

- banglashasyabima.net.in – Agricultural insurance scheme for farmers under the West Bengal government.

For any updates related to federal settlements or financial aid programs, users are encouraged to rely exclusively on official government websites.

Read More: Top 25 Grants For Disabled Women 2025: Apply Now

firsthomeownergrants.com :- The First Home Owner Grant is a one-time government payment in Australia to help first-time buyers purchase or build a new home.

Pingback: New Cash App Settlement Payout Date: 2025 | USA Federal Grants